Trading with Engulfing Candlesticks: Main Talking Points

Engulfing patterns in the

forex market provide a useful way for traders to enter the market in anticipation of a possible

reversal in the

trend.

This article explains what the engulfing candle pattern is, the trading

environment that gives rise to the pattern, and how to trade engulfing

candlesticks in forex.

Keep reading for information on:

- What is an engulfing candlestick and how do they signal a reversal of current trends in the market?

- There are two engulfing patterns to look out for: bullish engulfing and bearish engulfing patterns.

- Engulfing candle trading strategies

What is an Engulfing Candlestick?

Engulfing

candles tend to signal a reversal of the current trend in the market.

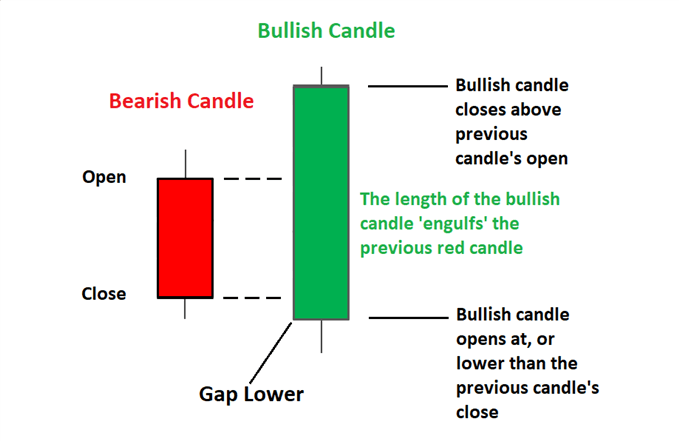

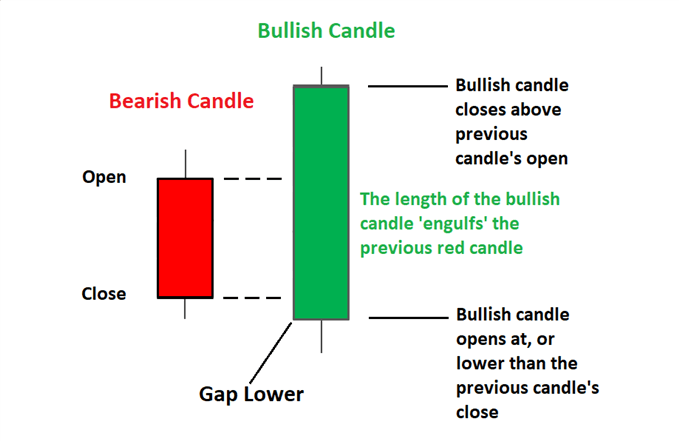

This specific pattern involves two candles with the latter candle

‘engulfing’ the entire body of the candle before it. The engulfing

candle can be bullish or bearish depending on where it forms in relation

to the existing trend. The image below presents the bullish engulfing

candle.

Types of Forex Engulfing Patterns

There are two engulfing candle patterns: bullish engulfing pattern and the bearish engulfing candle.

1) Bullish engulfing pattern

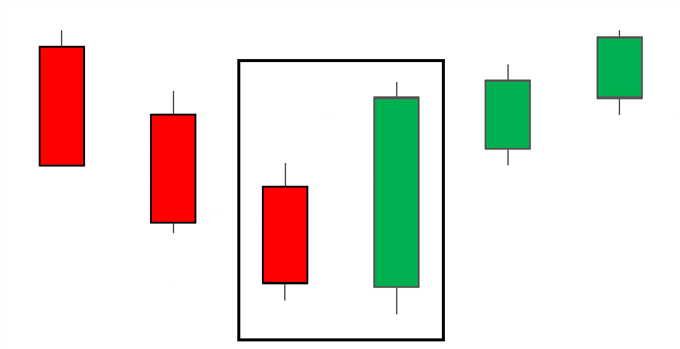

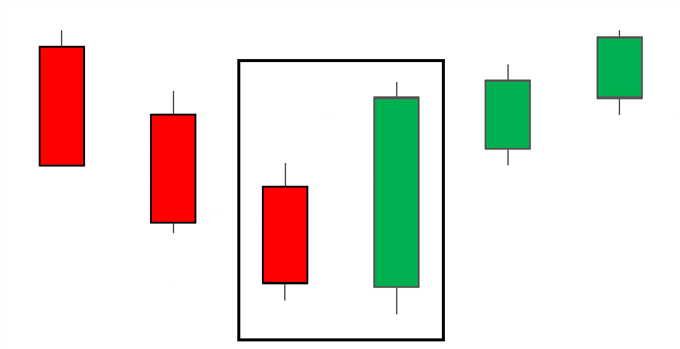

The

bullish engulfing candle

provides the strongest signal when appearing at the bottom of a

downtrend and indicates a surge in buying pressure. The bullish

engulfing pattern often triggers a reversal of an existing trend as more

buyers enter the market and drive prices up further. The pattern

involves two candles with the second candle completely engulfing the

‘body’ of the previous red candle.

Interpretation:

Price action must show a clear downtrend when the bullish pattern

appears. The large bullish candle shows that buyers are piling into the

market aggressively and this provides the initial bias for further

upward momentum. Traders will then look for confirmation that the trend

is indeed turning around by making use of

indicators, key levels of

support and resistance and subsequent price action after the engulfing pattern.

2) Bearish engulfing pattern

2) Bearish engulfing pattern

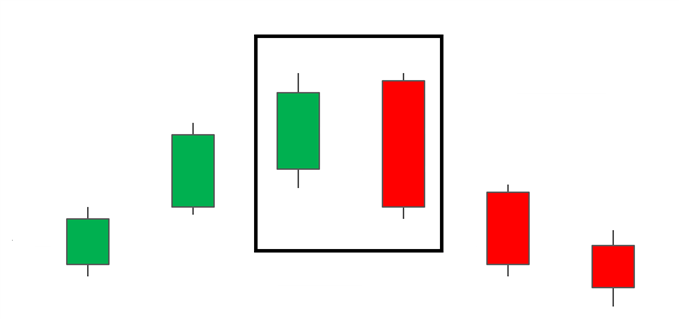

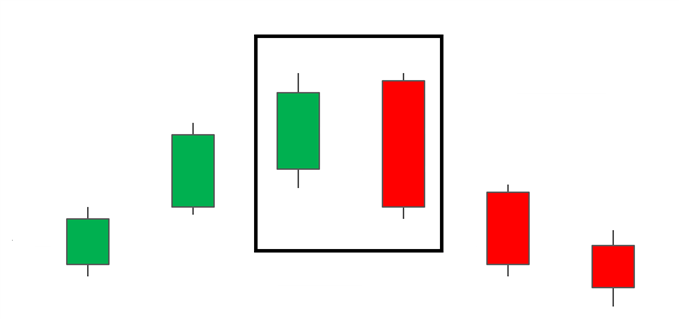

The

bearish engulfing pattern

is simply the opposite of the bullish pattern. It provides the

strongest signal when appearing at the top of an uptrend and indicates a

surge in selling pressure. The bearish engulfing candle often triggers a

reversal of an existing trend as more

sellers

enter the market and drive prices down further. The pattern involves

two candles with the second candle completely engulfing the ‘body’ of

the previous green candle.

Interpretation:

Price action must show a clear uptrend when the bearish pattern

appears. The large bearish candle shows that sellers are piling into the

market aggressively and this provides the initial bias for further

downward momentum. Traders will then look for confirmation that the

trend is indeed turning around by making use of indicators, levels of

support and resistance, and subsequent price action that occurs after

the engulfing pattern.

Why are Engulfing Candles Important for Traders?

Engulfing candles assist traders to spot reversals, indicate a strengthening trend, and assist traders with an exit signal:

- Reversals: Spotting

reversals are self-explanatory – it allows the trader to enter a trade

at the best possible level and ride the trend to completion.

- Trend continuation: Traders

can look to the engulfing pattern to support the continuation of the

existing trend, for example, spotting a bullish engulfing pattern during

an uptrend provides more conviction that the trend will continue.

- Exit strategy: The

pattern can also be used as a signal to exit an existing trade if the

trader holds a position in the existing trend which is coming to an end.

A

limitation of the engulfing candle can arise when the pattern turns out

to be more of a retracement than a definite change in direction, but

traders can look for subsequent price action to reduce the likelihood of

this undesirable outcome.

Engulfing Candle Trading Strategies

Using the Engulfing Candle Reversal Strategy

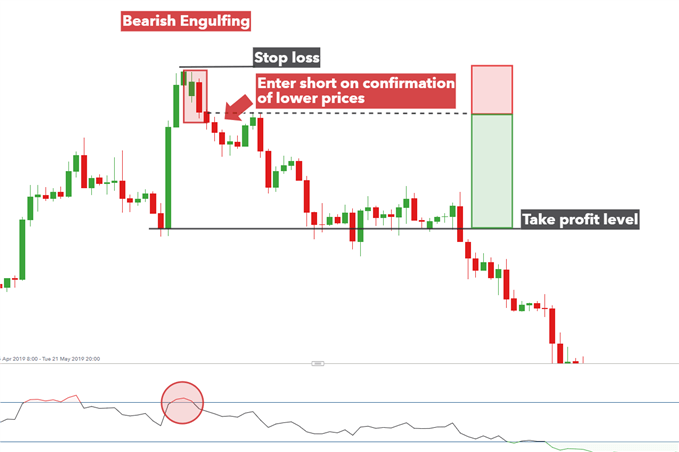

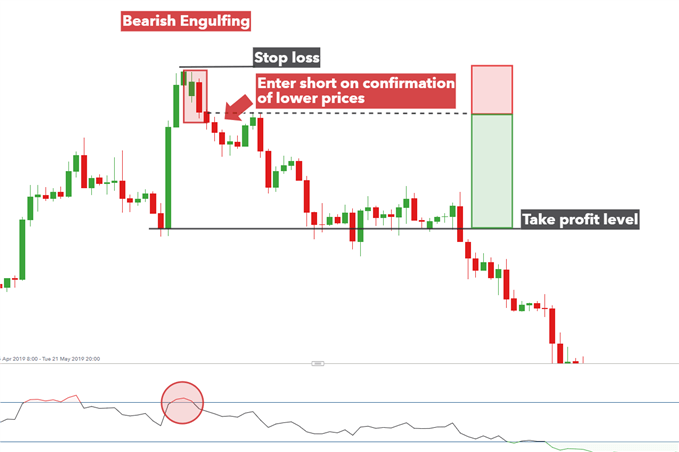

Traders

can look to trade the bearish engulfing pattern by waiting for

confirmation of the move by observing subsequent price action or to wait

for a pullback before initiating a trade.

See below for guidance on how to trade the engulfing candlestick pattern observed on the

GBP/USD four-hour chart.

- Entry:

Look for a successful close below the low of the bearish engulfing

candle. Alternatively, traders can look for a momentary retracement

(towards the dotted line) before entering a short trade.

- Stop: Stops can be placed above the swing high where the bearish engulfing pattern occurs.

- Target / take profit level: The target can set at a previous level of support while ensuring a positive risk to reward ratio. The risk to reward ratio is depicted by the green and red rectangles.

Using the Engulfing Candle When Trend Trading

Engulfing

candles don’t always have to appear at the end of a trend. When viewed

within a strong trend, traders can glean information from the candle

pattern pointing towards continued momentum in the direction of the

existing trend.

For example, the below chart shows a strong uptrend in the

S&P 500 with the appearance of multiple engulfing patterns (in the direction of the trend) adding more conviction to

long trades. Traders can enter a long trade after observing a close above the bullish candle.

Furthermore, this example includes the presence of a

bearish

engulfing pattern (red rectangle) that appeared at the top of the

trend, signaling a potential reversal. However, subsequent price action

did not validate this move as successive candles failed to close below

the low of the bearish engulfing candle and the market continued higher –

thus underscoring the importance of validating the pattern.

Learn more about trading with candlesticks