Bullish Engulfing Pattern

- The first day is a bearish candlestick, but can be a doji as well.

- The second day is a bullish candlestick that is larger in height than the first day’s candlestick.

- Lastly, the open and low of the second day should be lower in price than the first day’s close and the second day’s close and high should be higher in price than the first day’s open.

- The strictest description of a bullish engulfing candlestick pattern requires that the real body of the second day be larger than the first day’s candlestick which would include its upper and lower shadow.

Traits That Improve the Bullish Engulfing Pattern's Effectiveness

According to Nison (1991, p. 39) the following traits increase the odds that a bullish engulfing pattern is an important reversal indicator:- The first day has a very small real body and the second day has a very long real body.

Reasoning: A small bearish candlestick after a downtrend shows the bears are unable to push prices as low as they have during the prior trend. A small bearish candlestick shows the bears have less power; whereas, a large bearish candlestick shows the bears having more power. Likewise, a large bullish candlestick that defies the previous downtrend shows that bulls came back into the market and the bears were unable to stop them. The longer the bullish candlestick the greater the show of force by the bulls. - The bullish engulfing pattern occurs after a long downtrend or a very quick move lower.

Reasoning: Sellers or traders who are shorting have probably already done so after an extended move downward and therefore there are fewer potential sellers or shorters. In the case of a sudden move downward, often these quick moves are overdone and are susceptible to reversals. - Volume on the second day candlestick is very large.

Reasoning: The fact that unusually high amounts of volume were transacted on a large bullish candlestick means that there was a large turnover of shares throughout the day and that traders had to bid up prices in order to buy shares, which is very bullish. Explaining this using supply and demand basics, if there are less traders willing to sell their shares (ie less supply) and there are more traders willing to buy shares (ie more demand), then prices should rise, hence creating a bullish candlestick where prices opened and climbed throughout the trading day to close higher. - The second day’s real body is larger than several previous days’ candlestick heights.

Reasoning: Many small candlesticks show indecision. A large bullish candlestick that is larger than the previous indecisive candlesticks shows that the market has finally made a decision and the decision is to move upward. - The bullish engulfing pattern occurs in an area of support.

Reasoning: Support is an area where historically bulls have come into a market to buy at a certain price level. If the bullish engulfing pattern occurs at this support price level, then a trader might feel more confident buying because the support acts as another bullish confirmation.

Trading Suggestions for the Bullish Engulfing Candlestick Pattern

For those traders that go long based on the bullish engulfing pattern, Nison (2003, p. 66) suggests placing a stop loss order under the lows of the bullish engulfing pattern, since the bullish engulfing pattern should act as an area of support.Bullish Engulfing Pattern Blended Candle = Hammer

Bullish Engulfing Pattern Confirmation of Support

Bullish Engulfing Pattern Creating New Support

Bullish Engulfing Pattern 2nd Day High Volume Confirmation

What is an engulfing candlestick pattern?

Engulfing candlestick patterns are comprised of two bars on a price chart. They are used to indicate a market reversal. The second candlestick will be much larger than the first, so that it completely covers or ‘engulfs’ the length of the previous bar. There are two types:They can indicate that the market is about to change direction after a previous trend. Whether this is bullish or bearish signal will depend on the order of the candles.

The body of a candlestick represents the open-to-close range of each trading period, which can range from a second to a month or more – depending on your chart settings. Looking at two bars next to each other will provide a clear comparison of the market movement from one period to the next. The colour of the candle will indicate whether the price direction has been up (green) or down (red).

For a perfect engulfing candle, no part of the first candle can exceed the wick (also known as the shadow) of the second candle. This means that the high and low of the second candle covers the entirety of the first one. However, the main focus is on the real body of the candle.

Engulfing candles are one of the most popular candlestick patterns, used to determine whether the market is experiencing upward or downward pressure. However, it is important to remember that engulfing candles are a lagging technical indicator – meaning they occur after price action – as they require the previous two candlesticks’ worth of data before the signal is given.

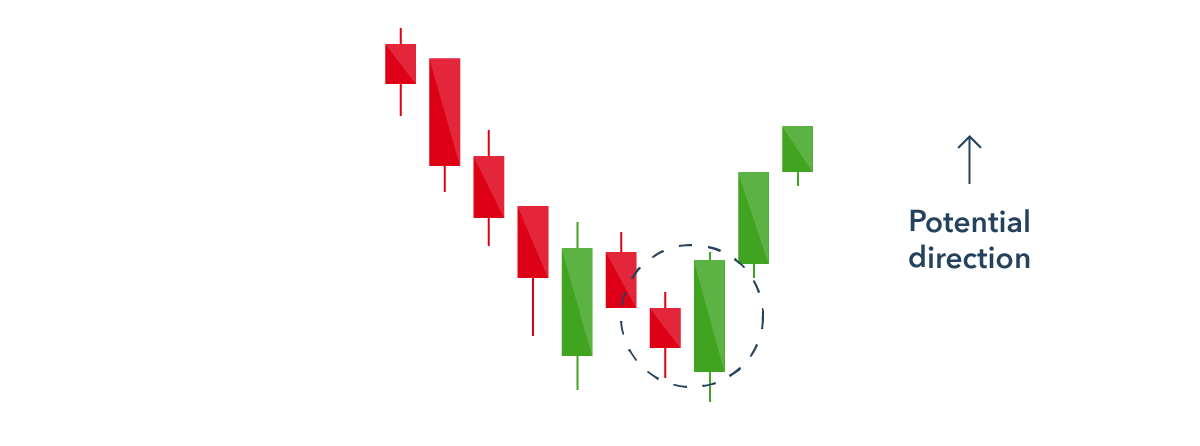

Bullish engulfing candles explained

A bullish engulfing pattern appears in a downtrend. It is formed of a short red candle next to a much larger green candle.The first candlestick shows that the bears were in charge of the market. Although the second period opens lower than the first, the new bullish pressure pushes the market price upwards – often to such an extent the second candle is twice the size of the previous one.

What do bullish engulfing candlesticks tell traders?

The bullish candlestick tells traders that buyers are in full control of the market, following a previous bearish run. It is often seen as a signal to buy the market – known as going long – to take advantage of the market reversal. The bullish pattern is also a sign for those in a short position to consider closing their trade.Although the wicks of the candles are not as important as the bodies for an engulfing pattern, the second candle in a bullish engulfing can provide a good indication of where to place a stop-loss for a long position. This is because it shows what the minimum price someone is willing to accept in exchange for an asset at that given point in time. So, if the current uptrend does reverse, you can see a clear exit point for your position.

When looking at a bullish engulfing pattern it is important to look at the previous candles as well to confirm the price action, and use the appropriate technical analysis indicators to confirm the reversal.

Practise using bullish engulfing candlestick patterns in a risk-free environment by opening an IG demo account.

Example of a bullish engulfing pattern

Looking at the below GBP/USD price chart, we can see that the bullish engulfing pattern consists of a green candle engulfing a previous red candle.Although the wick of the red candle is longer than the green, the body of the green is nearly twice the size of its predecessor. The following seven days indicate a bullish trend, before a bearish reversal can be seen.

Bearish engulfing candles explained

A bearish engulfing pattern is the opposite of a bullish engulfing; it comprises of a short green candle that is completely covered by the following red candle.The first candlestick shows that the bulls were in charge of the market, while the second shows that bearish pressure pushed the market price lower. The second period will open higher than the previous day but finish significantly lower.

What do bearish engulfing candlesticks tell traders?

A bearish engulfing pattern tells traders that the market is about to enter a downtrend, following a previous increase in prices. The reversal pattern is a signal that bears have taken over the market and could be about to push the prices down even further – it is often seen as the sign to enter a short position or ‘short-sell’ the market.The pattern is also a sign for those in a long position to consider closing their trade.

Again, although the wicks are usually not considered a core part of the pattern, they can provide an idea of where to place a stop-loss. For a bearish engulfing pattern, you’d put a stop-loss at the top of the red candle’s wick as this is the highest price the buyers were willing to pay for the asset before the downturn.

Practise using bearish engulfing candlestick patterns in a risk-free environment by opening an IG demo account.

Example of a bearish engulfing pattern

By looking at the USD/JPY chart below, we can see an example of a bearish reversal. The green candlestick signifies the last bullish day of a slow market upturn, while the red candlestick shows the start of a significant decline.The second candle opens at a similar level but declines throughout the day to close significantly lower.

How to use engulfing candlesticks

Engulfing candlesticks can be used to identify trend reversals and form a part of technical analysis. They are most commonly used as a part of a forex strategy as they can provide quick indications of where the market price might move, which is vital in such a volatile market.

Engulfing candlesticks are just one part of a technical analysis strategy. They are usually used alongside volume indicators – such as the RSI – that can show the strength of a trend.

To start using engulfing candlesticks, you can:

- Create a demo account to practise trading in a risk-free environment

- Open a live trading account to put your technical analysis into action

Bullish and bearish engulfing candlestick patterns summed up

- Engulfing candlestick patterns are comprised of two bars on a price chart

- They are used to indicate a market reversal

- The second candlestick will be much larger than the first, so that it completely covers or ‘engulfs’ the length of the previous bar

- A bullish engulfing pattern will be made of a shorter red bar being engulfed by a longer green bar. This indicates a bearish trend is coming to an end, ready for an uptrend

- A bearish engulfing pattern will be made of a shorter green bar being engulfed by a longer red bar. This indicates a bullish trend is coming to an end, ready for a downtrend

- They are a common part of a forex trading strategy

- Engulfing candlesticks are a lagging indicator, meaning they give the signal to enter a trade after the price movement has occurred

1 comment:

it is verry good information also provided in fully detail..

Post a Comment